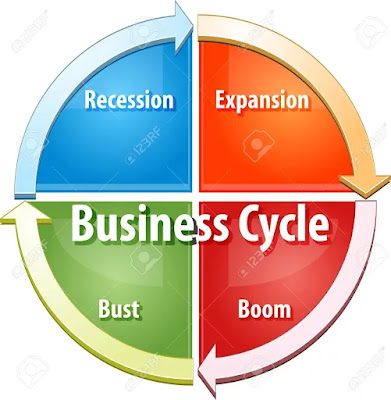

As emphasized priorly, Keynesians staunchly believe in activist policies to reduce the amplitude of the business cycle. According to Keynes, the business cycle is the root of all economic evils and is the most important of all economic problems. To tackle this, Keynes advocated for countercyclical fiscal policies that act against the direction of the business cycle. For example, deficit spending on labor-intensive infrastructure projects to stimulate employment and stabilize wages during periods of economic downturns. In a situation of abundant demand-side growth, Keynesians would lobby for raising taxes to cool the economy and prevent inflation. They also rely on monetary policies in certain situations (minus periods of liquidity trap) to stimulate the economy, like reducing interest rates to encourage investments.

Today, I attended quite an interesting Public Economics lecture on government grants. My professor was talking about how the US government had approved $2.2 trillion worth of loans and grants in order to soften the blow of the COVID-19 pandemic on the most affected families and businesses. He then asked a fundamental question that left us pondering: "Do these hefty government grants and packages financed by taxpayers' money which benefits only a select few make good economic sense?" This brings us back to the 20th century, specifically the 1930's, and how Keynes's influential ideas led to aggressive government policies, rescuing the global economy from the Great Depression. Keynes was a staunch proponent of short-term policy interventions and famously believed that, "In the long run, we are all dead." Yes, things might get better in the future, but why wait for when no one will be alive to reap the fruits of the future? In times of economic crisis, the...

Comments

Post a Comment